If Obama would just stfu the stock market might stabilize.

because it has nothing to do with the increase debt, dwindling manufacturing, large numbers of unemployed, devaluing dollar, lower credit rating and the fact that foriegn countries have lost faith in the dollar! Nope it's cause something obummer said!!!

Actually mobay, I think it is more of something he has done -nothing constructive. He talks a good game but can't play the game. You've heard about those guys that are all talk and no action? The part of his life that we see is just that - all talk.

first off he has done what bush did, raised debt ceiling, stimulus package, starting wars and free trade!!!

No, answer me this : why do we not coin our own interest free currency( it is in the constitution), has the free trade deals helped the economy and inflation comes from the federal reserve's fiat money, every time they print money inflation goes up. fiat money is money without any solid backing like gold. fiat money always crashes (prove this wrong look through history and see for yourself)

By 1455, after over 600 years, the Chinese abandoned paper money due to numerous problems of over issuance and hyperinflation. An in-depth description of China's first experience with money can be found here .

Paper Money in Europe

The first instance of paper money in Europe allegedly occurred in Spain in 1438 during a Moorish invasion. A Spanish military leader issued paper notes to his soldiers that circulated around the city. No known notes have survived.

In 1574, the Dutch city of Leyden issued cardboard coins made from the cover of prayer books while Holland was trying to regain its independence from the invading Spanish.

The Italian city of Candia later issued paper money of different denominations until a shipment of coins arrived from Venice. All notes were fully reimbursed.

In 1633, the earliest known English goldsmith certificates were being used not only as receipts for reclaiming deposits but also as evidence of ability to pay.

In 1656, the Bank of Sweden was founded with a charter that authorized it to accept deposits, grant loans and mortgages, and issue bills of credit.

By 1660, the English Goldsmiths' receipts became a convenient alternative to handling coins or bullion. The realisation by goldsmiths that borrowers would find them just as convenient as depositors marks the start of the use of banknotes in England.

In 1661, the Bank of Sweden became the first chartered bank in Europe to issues notes known as the paper daler.

Figure 2. A 50-Daler note from the Bank of Sweden issued in 1666.

By the 1680's, the use of paper money began to take place in other European countries and the New World. Circulated notes on playing cards were used in the French colony of Lower Canada. Other colonies soon developed their own paper notes.

Existing Currencies in Circulation

At present there are 176 currencies in circulation in the world. Not all currencies are widely used and accepted, such as the various unofficial banknotes of the crown dependencies (Isle of Man and the Balliwicks of Jersey and Guernsey).

The median age for all existing currencies in circulation is only 39 years and at least one, the Zimbabwe dollar, is in the throes of hyperinflation. The twenty longest running currencies are listed below.

| Currency |

Inception |

Years of Circulation |

Status |

| Pound Sterling (GBP) |

1694 |

315 |

In circulation |

| Scotland Pound (SSP) |

1727 |

282 |

In circulation* |

| US Dollar (USD) |

1792 |

217 |

In circulation |

| Netherlands Guilder (NLG) |

1814 |

188 |

EURO (2002) |

| Swiss Franc (CHF) |

1825 |

184 |

In circulation |

| Guernsey Pound Sterling (GGP) |

1827 |

182 |

In circulation* |

| Mexico Silver Peso (MXP) |

1822 |

170 |

Hyperinflation |

| Canadian Dollar (CAD) |

1841 |

168 |

In circulation |

| Belgian Franc (BEF) |

1835 |

167 |

EURO (2002) |

| Cuban Peso (CUP) |

1857 |

150 |

In circulation* |

| India Rupee (INR) |

1861 |

148 |

In circulation |

| Manx Pound (IMP) |

1865 |

144 |

In circulation* |

| Austrian Paper Gulden (ATP) |

1753 |

139 |

Replaced for 1:2 Austria-Hungarian Kronen in 1892 |

| Japanese Yen (JPY) |

1871 |

138 |

In circulation |

| Haiti Gourde (HTG) |

1872 |

137 |

In circulation |

| Swedish Krona (SEK) |

1874 |

135 |

In circulation |

| Danish Krone (DKK) |

1875 |

134 |

In circulation |

| Spanish Peseta (ESP) |

1874 |

128 |

EURO (2002) |

| Peru Sol (PEH) |

1864 |

121 |

Destroyed by hyperinflation in 1985 |

| Italian Lira (ITL) |

1882 |

120 |

EURO (2002) |

*Not officially recognized or valued outside issuing region.

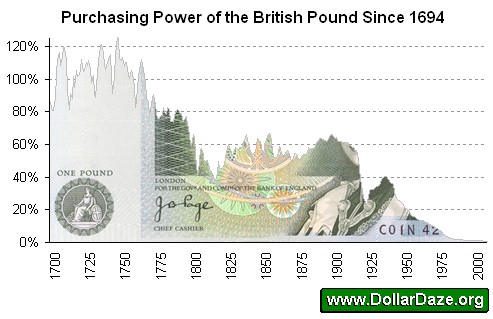

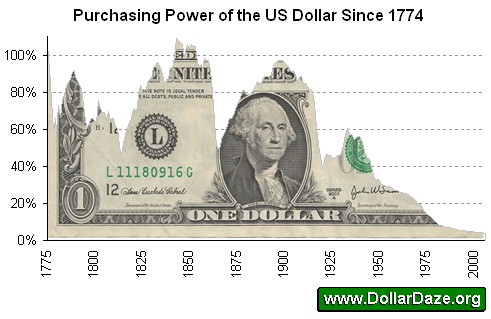

Below are charts showing the declining value of the two longest running currencies - the British pound sterling and the United States dollar, considered to be the most successful paper currencies of all time.

The British Pound originally represented one troy pound of sterling silver back in 1560. Sterling silver is 92.5% pure silver and there are 12 troy ounces in a troy pound. Elizabeth I and her advisor Sir Thomas Gresham (of Gresham's Law fame) established the new currency to bring about order created by the "Great Debasement" of 1543-51 when Henry VIII sought to finance his costly wars with both France and Scotland.

Paper banknotes were issued shortly after the establishment of the Bank of England in 1694.

As of Feb 23, 2007 it now takes 86.2 GBP to purchase that same troy pound of sterling silver - a loss of 98.8%!

Under the US Mint Act of 1792, the dollar was pegged at 24.75 grains of gold. There are 480 grains in a troy ounce. Thus it took 19.4 US dollars to purchase a single troy ounce of gold. As of Feb 23, 2007 it takes nearly 863 US dollar to purchase that same troy ounce of gold, representing a 97.8% drop in value!

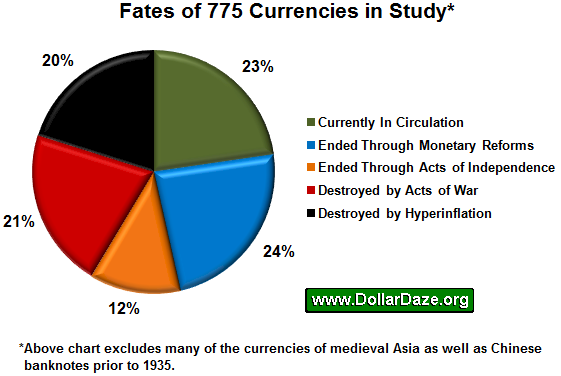

Currencies No Longer in Circulation

This analysis includes 599 currencies that are no longer in circulation . The median age for these currencies is only fifteen years! [2]

The following table below groups the fates of these currencies.

| Currency was... |

No. Of Currencies |

Description |

| Ended through monetary unions, dissolution or other reforms |

184 |

Voluntary monetary unions such as the Euro in 1999, or creation of the US dollar in 1792. |

| Ended through acts of independence |

94 |

Acts of former colonial entities renaming or reforming their currency |

| Destroyed by hyperinflation |

156 |

Currency destroyed through over-issuance by the government. |

| Destroyed by acts of war |

165 |

Currency deemed no longer valid through military occupation or liberation. |

The Second World War saw at least 95 currencies vanish as nations were conquered and liberated.

Hyperinflation is one of the greatest calamities to strike a nation. [3] This devastating process has destroyed currencies in the United States, France, Germany, and many other countries .

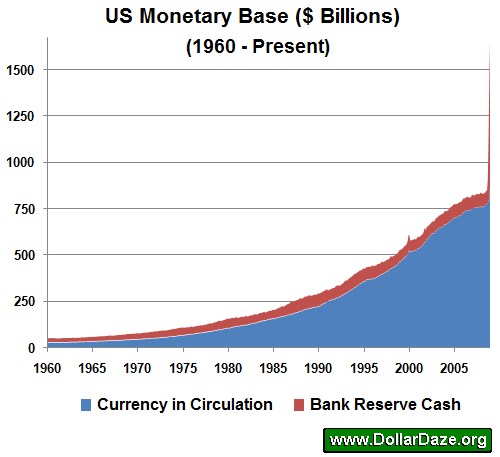

Recent Expansions to the US Monetary Base

The monetary base comprises of currency in circulation (banknotes and coins) and the commercial banks' reserves with the central bank. Recently, there have been unprecedented increases to the bank reserve portion of the US monetary base .

Up until August 2008, the portion of the monetary base that consisted of bank reserves was between 8 - 12%. In December 2008, that proportion had risen to 47%! This drastic increase was due largely in part by the unwillingness of the banks to lend recent 'liquidity injections' from the Federal Reserve.

The following table shows the increases to the monetary base, as measured in US$ billions for the last six months of 2008. These actions by the Fed are responsible for the large spike on the right side of the above chart.

| Date |

Currency in Circulation (M0) |

Cash Held as Bank Reserves |

Total Monetary Base |

| Jul-08 |

774.8 |

71.7 |

846.5 |

| Aug-08 |

775.4 |

71.9 |

847.3 |

| Sep-08 |

776.8 |

131.2 |

908.0 |

| Oct-08 |

793.8 |

338.7 |

1132.5 |

| Nov-08 |

806.5 |

634.6 |

1441.1 |

| Dec-08 |

882.0 |

782.3 |

1664.3 |

These massive expansions to the US monetary base increase the probability of a complete collapse in the confidence of the value of the US dollar. This shift in sentiment would spark a hyperinflationary fate to the world's de facto reserve currency .

In a fiat money system, money is not backed by a physical commodity (i.e.: gold). Instead, the only thing that gives the money value is its relative scarcity and the faith placed in it by the people that use it. A good primer on the history of fiat money in the US can be found in a video provided by the Mises.org website.

In a fiat monetary system, there is no restrain on the amount of money that can be created. This allows unlimited credit creation. Initially, a rapid growth in the availability of credit is often mistaken for economic growth, as spending and business profits grow and frequently there is a rapid growth in equity prices. In the long run, however, the economy tends to suffer much more by the following contraction than it gained from the expansion in credit. This expansion in credit can be seen in the Debt/GDP ratio. We track the bubbles created by this expansion of debt at the inflation / deflation page.

In most cases, a fiat monetary system comes into existence as a result of excessive public debt. When the government is unable to repay all its debt in gold or silver, the temptation to remove physical backing rather than to default becomes irresistible. This was the case in 18th century France during the Law scheme, as well as in the 70s in the US, when Nixon removed the last link between the dollar and gold which is still in effect today.

Hyper-inflation is the terminal stage of any fiat currency. In hyper-inflation, money looses most of its value practically overnight. Hyper-inflation is often the result of increasing regular inflation to the point where all confidence in money is lost. In a fiat monetary system, the value of money is based on confidence, and once that confidence is gone, money irreversibly becomes worthless, regardless of its scarcity. Gold has replaced every fiat currency for the past 3000 years.

The United States has so far avoided hyper-inflation by shifting between a fiat and gold standard over the past 200 years.

|

1785-1861 - FIXED Gold standard 76 years   The founding fathers were concerned about the unrestrained control of the money supply. One thing they all agreed upon was the limitation on the issuance of money, The founding fathers were concerned about the unrestrained control of the money supply. One thing they all agreed upon was the limitation on the issuance of money,

Thomas Jefferson warned of the damage that would be caused if the people assigned control of the money supply to the banking sector, "I believe that banking institutions are more dangerous to our liberties than standing armies. Already they have raised up a money aristocracy that has set the government at defiance. This issuing power should be taken from the banks and restored to the people to whom it properly belongs. If the American people ever allow private banks to control the issue of currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children will wake up homeless on the continent their fathers conquered. I hope we shall crush in its birth the aristocracy of the moneyed corporations which already dare to challenge our Government to a trial of strength and bid defiance to the laws of our country" Thomas Jefferson, 1791

Many of the founding fathers experienced the damage caused by fiat currency. Most of the revolutionary war was financed by worthless currency called "Continentals".

The Continental Currency ("Not worth a Continental") that American colonists issued for the Continental Congress to finance the Revolutionary War was replaced by the US Dollar in 1785 when The Continental Congress adopted the dollar as the unit for national currency. At that time, private bank-note companies printed a variety of notes. After adoption of the Constitution in 1789, Congress chartered the First Bank of the United States and authorized it to issue paper bank notes to eliminate confusion and simplify trade. The U.S. Constitution (Section 10) forbids any state from making anything but gold or silver a legal tender. The Federal Monetary System was established in 1792 with the creation of the U.S. Mint in Philadelphia. The first American coins were struck in 1793. The U.S. Coinage Act of 1792, consistent with the Constitution, provided for a U.S. Mint, which stamped silver and gold coins. The importance of this Act cannot be stressed enough.

- One dollar was defined by statute as a specific weight of gold.

- The Act also invoked the death penalty for anyone found to be debasing money.

- President George Washington mentions the importance of the national currency backed by gold and silver throughout his initial term of office and he contributed his own silver for the initial coins minted.

- The purchase of The US Mint in Philadelphia, was the first money appropriated by Congress for a building to be used for a public purpose. It was purchased for a total of $4,266.67 on July 18, 1792.

|

1862-1879 - FLOATING fiat currency 7 years

The first use of fiat money (called Greenbacks) in the United States was in 1862, it was used as a tool to pay for the enormous cost of the Civil War. Greenbacks were a debt of the U.S. government, redeemable in gold at a future unspecified date. They were circulated along with Gold certificates, backed by the government’s promise to pay in gold.

|

1880-1914 - FIXED Gold standard 34 years

The US dollar was hard pegged to gold resulting in domestic price stability and virtually no inflation. The financial needs of WW1 ended this.

|

1915-1925 - FLOATING Fiat currency 10 years

In order to "pay" for WW1 countries had to print a lot of paper currency which by necessity mandated a delinking from gold because there wasn't enough gold to support the paper.

|

1926-1931 - FIXED Gold standard, 5 years

The gold exchange standard was established wherein each country pegged its currency to the US dollar and British pound which were then supposed to be backed by the dollar. When the depression began countries tried to cash in their pounds and dollars for gold. That "run" on gold forced the end of the gold exchange standard.

|

1931-1945 - FLOATING Fiat currency, 14 years

Fiat currencies reign worldwide leading to huge economic imbalances from country to country and was of the major contributing factors to the beginning of WW2.

|

1945-1968 - FIXED - Gold standard, 26 years

1944 Bretton Woods Accord (similar to gold exchange standard of 1926-1931) Two main currencies again, the US dollar and British pound. A run to convert pounds to gold collapsed the pound and began the end of the Bretton woods accord. It took 3 years while governments tried to salvage the system and also to determine what to do next. Kind of like having one leg on the boat and the other on shore. 1963 - New Federal Reserve notes with no promise to pay in "lawful money" was released. No guarantees, no value. This is also the year of the disappearance of the $1 silver certificate. Once again, a subtle shift in plain view.

1965 - Silver is completely eliminated in all coins save the Kennedy half-dollar, which was reduced to 40 percent silver by President Lyndon Johnson's authorization. The Coinage Act of 1965 signed by Lyndon Johnson, terminates the original legislation signed by George Washington 173 years earlier (carrying the death penalty) enabling the US Treasury to eliminate the silver content of all currency.

1968 - June 24 - President Johnson issued a proclamation that all Federal Reserve Silver Certificates were merely fiat legal tender and could not really be redeemed in silver.

|

1971 - FLOATING - Fiat currency, 5 months

August of 1971 President Nixon ended the international gold standard and for the first time no currency in the world had a gold backing.

|

1971-1973 - FIXED - Dollar standard, 2 years

The Smithsonian Agreement was passed pegging world currencies to the dollar rather than gold as a fixed exchange rate.

|

1973-? - FLOATING - Fiat currency, 30 years

The Basel Accord established the current floating exchange of currency rates we are operating under today.

|

A good barometer of the size of a currency's leverage is the percentage of total Debt to GDP (Gross Domestic Product). Currently, that percentage (299%) is higher than the level the nation experienced during the depression era 1930's. With budget deficits projected for 2003 and 2004, the US will soon exceed this already inflated level. |