For a quick summary of the Libya situation, check the bottom of this description.

I understand not all have the time to watch several of these videos, but at the very least watch the first one.

This one is a MUST WATCH, it's very complete, and has already got 70,000 views in 5 days!

Libya Truth

http://www.youtube.com/watch?v=aJURNC0e6Ek

The Real Reason for NATO Attacking Libya:

http://www.youtube.com/watch?v=O35_Ai6EsMU

The Truth About Libya: Exposing NATO Crimes & Mass Media Lies

http://www.youtube.com/watch?v=3hDejIHc1XI

Gaddafi's son: Libya like McDonald's for NATO - fast war as fast food

http://www.youtube.com/watch?v=RpMugPQC4ZY

This one is also a MUST WATCH:

Libyan Woman on Gaddafi

http://www.youtube.com/watch?v=_5EpvO47CUE

Media Lies About Libya and Gaddafi:

http://www.youtube.com/watch?v=t_ku0rLVdWg

About Libyan victims:

http://www.youtube.com/watch?v=lBapbq8etf0

Libyan Rebels Free AL QAEDA Supporters:

http://www.youtube.com/watch?v=uUeNBy3FjRM

Pro Gaddafi rally with 1.7 MILLION PEOPLE (that's 1/3 of the country's population):

http://www.youtube.com/watch?v=7AXjipjX6lU

Another pro Gaddafi rally with also millions:

http://www.youtube.com/watch?v=QPBorEsNiu0

LIBYA WAR GOLD AND THE BANKSTERS (This one is long, but has a lot of info)

http://www.youtube.com/watch?v=QbxrIeoFrzY&feature=related

EVEN WOMEN PICK UP GUNS TO DEFEND THEIR COUNTRY:

http://www.youtube.com/watch?v=5n71BzKPbIA

WAR ON LIBYA - ANONYMOUS REVOLUTION

http://www.youtube.com/watch?v=uEB1oevaaAY

----

EXCELENT article, must read:

Libya Burns As The World Cheers

http://www.informationclearinghouse.info/article27956.htm

The Truth About Libya

http://www.rense.com/general93/truth.htm

NATO handover of free Libyans to Bankers

http://powerpointparadise.com/blog/2011/08/nato-handover-of-free-libyans-to-b...

Libya all about oil, or central banking?

http://www.atimes.com/atimes/Middle_East/MD14Ak02.html

The Libyan crisis: spontaneous revolution or coup in progress?

http://economicsnewspaper.com/economics/the-libyan-crisis-spontaneous-revolut...

Libya: War Against Africa

http://saleil.blogspot.com/2011/06/libya-war-against-africa.html

We can't allow another Iraq.

In the 1950's, Libya was the poorest country in the world. Before the NATO invasion, Libya had become the country with the best quality of life in all Africa thanks to Gaddafi. The people of Libya support Gaddafi, they love his leader, but the media machine of NATO makes us believe this is a revolution similar to Egypt. "We are fighting the bad guy" That is all you hear in mainstream news, but is far from being the truth. A few months before this invasion, Gaddafi announced he was implementing a new currency, alongside most African countries. This would mean Africa would stop selling resources in Dollars and Euros, and would also mean a new powerful currency would get into the market, allowing progress for 3rd world countries in Africa. This of course, is not convenient for the powerful millionaires of the west. AND MOST IMPORTANT. Libya is the country in all Africa with the highest OIL reserves, and the cost of producing a barrel of oil is 100 times more cheap than in the rest of the world. Gaddafi did not permit oil companies to mess with Libyan oil. The Libyan oil was for the Libyan people. He also did not allowed world banks into his country. All loans were issued by the Libyan government at 0% interest. The rebels have already made a deal with oil companies to let them loot Libyan resources, and also made deals to allow a central bank run by Rothschild Family to be implemented in the country. Rothschild Family is a group of bankers that own all western banks, and are estimated to own over half the worlds wealth.

Oh and did I mention already that Gaddafi is the titular head of the nation, but he has no actual power? The true leader of Libya is an indirectly elected prime-minister. The current prime-minister is Baghdadi Mahmudi. Qaddafi is revered as the beloved 'Great Brother, Leader of the Revolution', he is more like an icon, a social leader. So much for the 'mad dictator' we hear about...

Don't believe me? All the information is on the videos and articles on this description. And that's just a fragment, do your research, don't let the government fool you with mainstream media. Whatever you hear on mainstream media about this war is complete lies.

Spread the word, the Libyan people need you. We may have our differences but remember, we are all citizens of the same world.

We are anonymous

We are legion

We do not forgive

We do not forget

Expect us

Just where does inflation come from – outer space, perhaps...? NOBODY LIKES INFLATION,

writes Aaron Krowne of ML-Implode, but inflation is a "fact of life" – a natural disaster, like a hurricane or earthquake.

Right?

Wrong. That is the impression policy makers and politicians have worked very hard for almost a century to create. But it is a bold-faced lie, meant to deflect your attention (and anger) away from the real culprit – them.

The fact of the matter is that prices in general can only go up if more money is created. When more money is created, that means each Dollar buys fewer goods and services. Your common sense is exactly right on this matter!

Sure, prices can rise in one area for natural reasons (such as crop failure), but prices must then go down in other areas. Because money that would normally be spent in them has to go to the area with higher prices.

The US government has a policy of continually creating more money every year, through an independent, private corporation, called the Federal Reserve. It is neither Federal, nor are there any meaningful "reserves". It has a total monopoly on the US money supply. The Fed has virtually no accountability to the public, except what it chooses to tell us.

Today the Fed finds it more convenient to pretend inflation comes from elsewhere (outer space, perhaps?). Yet it was actually created specifically to regularly expand the money supply ("print" more money). The argument was that this would "help growth" by making capital more available, and allow the authorities to "smooth over economic downturns."

They claimed they could retain the value of the Dollar, with careful management, and maintain "full employment". So they inflated the money supply on purpose.

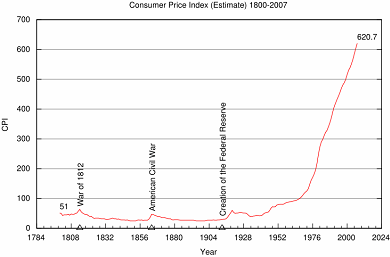

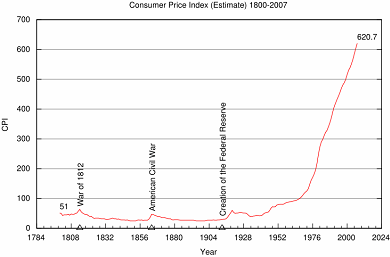

How have they done, since 1913, when the Fed was created? The value of the Dollar has been almost completely destroyed. The following chart shows the Consumer Price Index. As it rises, higher prices means each US Dollar is becoming less valuable.

That's right, the Dollar actually gained value from 1800 to 1900. Then the Fed came along.

- The Great Depression happened on their watch, after expanding money (mostly through bank credit) throughout the 20s. Then in 1929 the bubble burst;

- The 1970s/1980s "stagflation" (high inflation, high unemployment) happened on their watch;

- The S&L bubble and collapse happened on their watch;

- Numerous "minor" recessions happened (including 1990-91);

- A hedge fund called Long Term Capital Management collapsed in 1998 and almost destroyed the whole financial system (incidentally, this led to no reform on the part of anyone). The banks that lent to LTCM were under the regulatory authority of the Fed, and in fact, most are co-owners (shareholders) of the Fed;

- The Dot-Com Bubble happened; trillions in "wealth" vanished;

- The housing bubble happened. It is collapsing. Trillions in what was thought to be wealth, once again, are vanishing.

What has happened since 1913 has proven that, whatever the supposed benefits of inflation AS A POLICY CHOICE, the hazards are much worse.

Why did all of these ills happen? Because:

- Inflation re-distributes wealth from the poor and middle class to the rich and powerful; The "early receivers" of the newly-created money benefit; everyone else loses;

- Inflation destroys savings, making it impossible to retire on a lifetime of simple, prudent saving. In fact, it totally discourages savings, which is why the US now has a zero (or slightly negative) savings rate;

- Inflation encourages excess money to flow to Wall Street speculators, who create bubbles and eventual collapses, which allow them to skim wealth off the hapless public (in fact, bank losses are often covered directly by tax payers);

- Inflation erodes wages, putting everyone at a disadvantage who does not get a raise of at least the rate of inflation. This means most people are doing worse-off most years;

- Inflation empowers labor unions by making workers more dependent on political bargaining. The unions then collude with politicians and Wall Street to rip off workers anyway;

- Inflation distorts the economy, by putting capital in the hands of those who haven't earned it ("easy money"), who then proceed to waste it ("malinvestment"). Since their projects tend not to be of benefit to the economy (think flipping houses or over-priced defense contracting), they end up destroying wealth for everyone else.

This economic distortion and malinvestment creates unemployment. In times and places where inflation has been virtually unknown, unemployment has been virtually unknown (the US in the 19th century; Hong Kong and Switzerland until recently).

An inflation rate of just a few percent is enough to achieve all of these ills: at only three percent inflation per year, $100,000 shrinks to $40,100 in purchasing power in thirty years. At 5.5% inflation (which is likely closer to the true rate of inflation from 1980-2006), it takes only a bit over sixteen years to get there.

"Lenin was certainly right," as John Maynard Keynes – one of the two most influential economists of the 20th century – once noted. "There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency.

"The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose."

Why do governments like an inflationary system? Because it allows them to spend more money than they earn in tax revenues. In our version of the system, this is done by financial borrowing first (rather than literal "printing"), with the visible inflation following years later, making it difficult for the people to connect cause with effect.

In other words, instead of taxing you right now to spend right now, they tax you (and your children) later for today's spending, thinking you won't notice. The "tax" comes in the form of decreased purchasing power of your money, so it never has to be debated or pass through congress. This scam usually works!

"It is my view that what is important is cutting government spending, however spending is financed," believed Milton Friedman, the other most influential economist of the 20th century. "A so-called deficit is a disguised and hidden form of taxation. The real burden on the public is what government spends (and mandates others to spend)."

The government lies about inflation to make it appear like they are doing a better job than they really are. Here's how they do it.

First, the main inflation measure, the Consumer Price Index (CPI), is heavily manipulated. Among the manipulations are "hedonic adjustments", which mean the government assumes your computer is only half as expensive if becomes twice as fast; "substitution effect" assumptions, which means the government assumes there is no change in costs if steak becomes so expensive that you have to switch to hamburger; and selective weighting, through which major expenditures like health care are grossly under-represented.

Focus is then diverted from the CPI to the "core" CPI, which leaves out food and energy, for no good reason. Nowadays, this is causing the "core" CPI to look increasingly ridiculous.

If the government/Fed don't like the CPI, they use something called the "PCE", which is even lower, and prefer the "core PCE", which is even lower than that. The PCE, not the CPI, is used to calculate GDP (the nation's supposed productivity), leading to gross distortions of that number.

The government also pretends that asset bubbles (such as in stocks or house prices) aren't inflation. The problem with that logic is that when asset bubbles "pop", much of the money pours out of the effected markets and becomes good old goods and services inflation, showing up in the CPI.

This is happening right now (2008), in a big way.

If you believe the US Postal Service, costs have gone up about 5.5% a year from 1980-2006. But if you believe the Bureau of Labor Statistics (BLS), which calculates the CPI, costs only went up 3.2% over that time period. If the 5.5% number (which is based on USPS expenses, as represented by first-class postage) is right, that means that pensioners (people on social security) are being underpaid by at least 42%. In reality, the situation is likely even more extreme, given all the other points mentioned above.

How can inflation be avoided? The answer is simple: sound money – money backed by something with real, constant value, just like we used to have before the Fed. Historically, that "something" was

Gold and silver, in the form of notes exchangeable for them, and also usually coins made specifically of them, which have intrinsic value.

In fact, only sound money can really claim to be "money", because one of the main attributes of money is that it retains its value! Paper money (

also called "fiat") is actually only currency – good only for one-off exchange. It is backed by nothing (except promises to provide future paper money).

The only way this crazy fiat money system could have been put in place over honest, hardworking Americans is deception. While our current pure-fiat Federal Reserve Notes started being issued in 1914,

Gold and silver-backed Treasury notes were not withdrawn until later (1933, and 1964, with the last silver certificates accepted for exchange in 1968. The last coinage containing silver was in 1964).

So the sound money system was gradually phased out, with the American public playing the role of the proverbial "frog boiling in water".

The kind of sound money we used to have. Compare the wording to a Dollar from your wallet.

Sound money with

Gold and silver is the system that always arises naturally—unless government forces and fools people into accepting their paper promises along with the demon of inflation. After all, would you knowingly accept a piece of paper and a promise (for more pieces of paper) from a politician or a slick Wall Street banker in exchange for real goods or services...unless someone was forcing you to do so at gun point?

We didn't think so.

And while you may have to accept fiat money (currency) in payment for work or trade right now due to the law, they can't make you use the stuff for savings. Luckily, you can put your money into

Gold and silver. Ownership of

Gold was re-legalized for Americans in 1974 (FDR "took the right away" in 1933 to help impose paper money.

The Constitution is NOT a list of what the federal government cannot do. It is NOT a list of prohibitions on the federal government.

The Constitution IS a list of what the federal government is authorized to do, with ALL ELSE being DENIED to it by default. The absense of specific constitutional authorization for anything means that the federal government is denied/prohibited by default.

Amendments 9 & 10 are probably the clearest and most simple explanation of that point:

Article I, Section 10, Clause 1: No State shall…coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debt.

1. The federal government can coin money.

2. States cannot coin money.

3. States have the authority of determining what can be used as a tender in payment of debts by default, because the federal government does not have that specific constitutional authorization.

4. States are then prohibited by the Constitution from making any Thing but gold or silver coin a tender in payment of debts. (Which also additionally proves that #3 is correct.)

Regarding your other question about the Federal Reserve... in order for the Federal Reserve to be legal, as per the highest law of our land, it MUST be specifically authorized by the Constitution. It is not, therefore it is forbidden by default.

By the way, in case you weren't aware - the Federal Reserve is our nation's THIRD incarnation of a central bank.