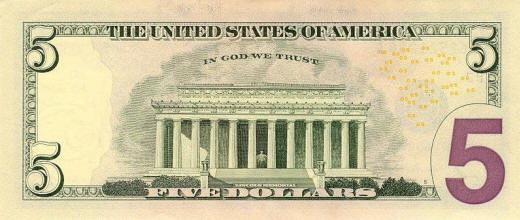

Study finds median wealth for single black women $5

Women of all races bring home less income and own fewer assets, on average, than men of the same race, but for single black women the disparities are so overwhelmingly great that even in their prime working years their median wealth amounts to only $5

In a groundbreaking report released Monday by a leading economic research group, social scientists turned a spotlight on the grave financial challenges facing an often overlooked group of women, many of whom could not take an unpaid sick day or repair a major appliance without going into debt.

“It’s rather shocking,” said Meizhu Lui, director of the Closing the Gap Initiative based in Oakland, Calif., who contributed to the report “Lifting as We Climb: Women of Color, Wealth and America’s Future.”

“Even for those of us who have been looking at the wealth gap for a while, we were shocked and amazed at how little women of color have,” Ms. Lui said.

Researchers at the Insight Center for Community Economic Development, based in Oakland, Calif., analyzed data from the 2007 Survey of Consumer Finances, a voluminous report the Federal Reserve Board issues every three years that examines household finances in this country.

Wealth, or net worth, measures the total of one’s assets — cash in the bank, stocks, bonds and real estate; minus debts — home mortgages, auto loans, credit cards and student loans. The most recent financial data was collected before the economic downturn, so the current numbers likely are worse now than at the time of the study.

Black women, in general, were more likely to have participated in the subprime loan crisis with upper-income black women being five times more likely to have received a high-cost mortgage than upper-income white men.

“The popular image is they spend too much, which is the reason they are running up credit card and consumer debt, but the cost of living has risen faster than income, and they need to go into debt for basic daily necessities,” Ms. Lui said. “It’s compounded because unemployment is twice as high in the black community than it is in the white community.”

For all working-age black women 18 to 64, the financial picture is bleak. Their median household wealth is only $100. Hispanic women in that age group have a median wealth of $120.

“That means half of [black women] have a net worth of more than $100 and half have a net worth of less than $100,” Ms. Lui said. “So that gives you an idea of how far in debt some women of color are.”

Married or cohabitating white women have a median wealth of $167,500. Married or cohabitating black women have a median net worth of $31,500.

The reasons behind the daunting financial challenges black women face are numerous and complex.

“There are excuses and circumstances that have evolved in society, which put black women where they are,” said Esther Bush, executive director of the Urban League of Greater Pittsburgh, who said in Pittsburgh more than 70 percent of African-American families are headed by single women.

The recession has hit single mothers especially hard.

According to a recent report by the Institute for Women’s Policy Research and the Women and Girls Foundation of Southwest Pennsylvania, more than four out of 10 families headed by single mothers in Pittsburgh and more than one in three in Pennsylvania, live in poverty.

In Pittsburgh and across the country, the financial burdens of single parenthood fall mostly on women, but black women are more likely to endure the work and responsibility of raising children on their own. They are more likely to be the backbone of their families and communities, with greater responsibilities to support struggling friends and families.

In a 2008 study of black women and their money, the ING Foundation found that black women — who frequently manage the assets of their households — financially support friends, family and their houses of worship to a much greater degree than the general population.

They also are more likely to be employed in jobs and industries — such as service occupations — with lower pay and less access to health insurance. And when their working days are done, they rely most heavily on Social Security because they are less likely to have personal savings, retirement accounts or company pensions. Their Social Security benefits are likely to be lower, too, because of their low earnings.

Rather than strictly comparing income, researchers in the Insight study looked at the wealth gap. The current economic crisis has shown that a person’s wealth affects not only retirement security, but also a person’s ability to handle financial setbacks such as a job loss or a health emergency.

High unemployment and high incarceration rates for black men also lower the likelihood of single black women finding a partner to help build a more secure financial future.

Ms. Lui said the Insight report would be used to encourage the government to close the wealth gap and improve the outlook for women of color, just as it did for Americans who received land through the Homestead Act, and education through the GI bill.

“If wealth was based on hard work, African-Americans would be the wealthiest people in our nation,” she said. “It’s not about behavior. It’s about government policies. Who does the government help and who is it not helping?

“Our government knows how to build wealth for people. They’ve done it for others and they can do it for all of us. They need to focus some attention on women of color. Look at the situation and see what we need.”