Membership in a community association brings many benefits and advantages, but those come at a price.

Each year, members are billed for their portion of the common expenses of the association. This charge is often called an assessment or dues for single-family residence communities and maintenance fees for condominium complexes. Depending on their specific collection procedures, associations collect assessments annually, quarterly, or in monthly installments.

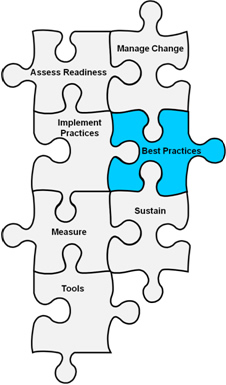

In order for the association to perform the many tasks and duties for which it is responsible, the association must have operating funds. These funds are used to pay for maintenance, repairs, administration, and to hopefully maintain adequate reserve funds for major repairs to or replacement of common property elements.

The requirement upon an owner for paying assessments is mandatory and, therefore, legally binding based upon its inclusion in the association's governing documents. The governing documents of an association typically provide other references to assessments including the purpose or use of an assessment, the basis for calculating an assessment, payment procedures, collection procedures for delinquent assessments, and authority for levying fines, fees, and other charges.

The amount of the annual assessment is established each year by the association's board of directors based upon the board's adoption of the annual budget. Typical governing documents may include language allowing the board to increase, without owner approval, assessments in order to fund an operating expense shortfall. An example of this type of shortfall would include a large unexpected increase in insurance premiums (as resulted in many cases from the tragic September 11, 2001, terrorist attacks). However, the governing documents often limit the amount/percentage by which assessments may be increased in a given year.

As mentioned, the assessment requires each owner in the community to pay an equal share for operation of the association. Assessments are the financial lifeblood of the association because they are the association's primary source of income. When owners do not pay their assessments in a timely fashion, it can jeopardize the association's economic health and stability. Without that source of income, the association would be unable to provide services to the owners, thereby deferring necessary maintenance to roofs, siding, and other responsibilities. Delay in performing required maintenance can put an association at a greater risk for damage from storms, and this damage may not be covered by insurance if necessary maintenance was neglected.

The failure of an owner to pay an assessment can result in legal and financial penalties to the owner. Those penalties can lead an association to pursue whatever legal means necessary and available to collect this debt. Collection procedures often include a report of the owner's debt to a credit bureau, filing of a contractual lien on the delinquent owner's property. Collection actions can ultimately result in the association foreclosing upon that property for payment of the delinquent debt. This is an extreme action, but can become necessary for the board to pursue in order to fulfill its fiduciary responsibilities to the other owners.

In addition to the regular assessments, many associations find themselves in the position of proposing a special assessment. Special assessments are often a one-time or short-term assessment collected to cover a major or unexpected expense. Approval of a special assessment most often requires approval by a majority vote of the owners. Examples of major expenses requiring a special assessment include: the replacement of siding, private roads, or roofing in a condominium complex; replacement or renovation of a community clubhouse; addition of community tennis courts or a swimming pool; or addition or replacement of access gates. If appropriate long-term planning is used and adequate reserve funds set aside, special assessments often can be avoided. Including the cost of anticipated repairs in the regular assessment amounts helps distribute the actual replacement cost more fairly to all owners by allocating that cost over the actual time an owner owns a unit. Requiring special assessments to replace or repair existing items rather than providing new amenities is often viewed as the result of poor planning. This may unfairly burden new owners who anticipated routine repairs and maintenance to have been already been completed.

An association usually is provided the authority through its governing documents to charge late fees, collection costs, penalties, interest, and attorney fees for owners who are delinquent in their assessments. Although not a significant source of income for an association, these fees are primarily used as an incentive to encourage timely payment of amounts owed to the association and to pay the costs associated with pursuing the delinquent balance Reporting an owner to a credit bureau or engaging an attorney to send demand letters is an up-front expense to an association and repaid when the owner brings their account current.

While payment of assessments, dues, or fees is sometimes considered financially burdensome by an owner paying their monthly mortgage and taxes, assessments are used to make sure the association can do its job for the membership. A financially viable association able to perform its duties will lead to a better community and, as a result, protection of property values.

Related Articles

- How To Collect Delinquent HOA Dues And Fees

- What is an HOA or Homeowner Association?

- How to Start a Neighborhood Association

- HOA Website Can Save Money And Increase Communication

- How Neighborhood Assoc Websites Can Increase Participation

- A Condo Association Website Can Facilitate Communication

- Neighborhood Watch-How to Start One!

- Utilizing a Neighborhood Watch Website

- An Effective Meeting Agenda

- Funding a Reserve Study

- HOA Maintenance - Who Has Responsibility for What?

- Budget Preparation Tips

- Directory of Association Articles

Print

Print Email

Email