Are your prescription drugs covered by your health insurance plan? Supplemental prescription insurance can protect you from the high cost of medications.

Health Insurance Plans Often Don't Cover Prescription Medications

Does your health insurance policy cover prescription medications? Does your health insurance plan just cover some medicine, or have a severe limit on your coverage of prescription medicine? Any health insurance policy without prescription drug coverage leaves you unprotected from the high cost of medications.

The cost of prescription medication continues to climb, and health insurance companies are trying to control their drug costs. To avoid these costs, many health insurance policies do not include coverage for prescriptions. On the other hand, some health insurance companies do offer a variety of prescription insurance plans. Prescription insurance plans that come with regular policies through major medical insurance companies can be expensive. Other, more specialized prescription insurance companies offer more affordable coverage for medications as a supplement to a regular policy.

Benefits of Prescription Insurance

There are many prescription insurance plans that provide a variety drug coverage. These supplemental prescription policies can have several benefits. They can:

- Cover specialized medications.

- Save you money with long-term prescriptions.

- Reduce the cost of all medications, even generic drugs.

- Decrease out-of-pocket and co-pay expenses.

- Save you time and money with a mail order option.

Finding the Right Prescription Insurance

What's the right prescription insurance for you? With the help of your doctor, clearly determine what kinds of prescription medications you need covered. Once you have a clear understanding of the types of drugs you need covered, consider your budget. There is a wide range of prescription insurance plans with an equally wide range of pricing. Be sure to find the right balance between coverage and costs.

The list of medications that your health insurance company will cover is called a formulary. The drugs in a formulary generally fall into these categories:

- Generic drugs - the least expensive.

- Preferred (brand name) drugs - priced in the middle.

- Non-preferred brand-name drugs - the most expensive.

Health insurance policies that cover prescription medications organize drugs by category, and usually determine the amount of coverage you will receive by those categories. Understanding prescription drug categories with your doctor will help you decide on the best prescription insurance plan for you.

Related Articles

- Pick The Medicare Part D Plan That's Right For You!

- Supplemental Insurance - What Is It?

- Medigap Supplemental Insurance Explained

- Medicare Prescription Drug Coverage

- Do You Need Medicare Part D Insurance?

- Managing Your Aging Parents Finances

- Increase Your Social Security Benefits

- Resources For Seniors

- Affordable health insurance: How to save on your health-care costs

- Purchasing Individual Health Insurance: What you need to know

- Do You Need Long Term Care Insurance?

- Why You Need Long Term Disability Insurance

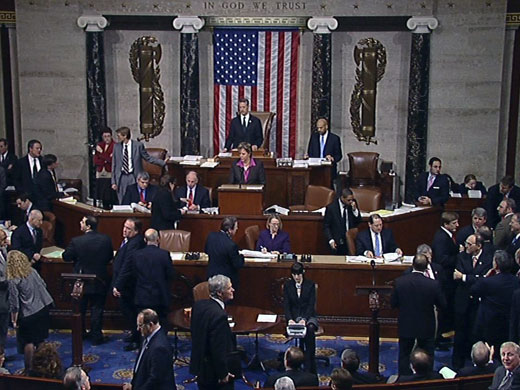

- What Does Health Care Reform Mean for Me?

- Health Care Reform Bill Timeline

- What is a Health Insurance Exchange?

- Prescription Drugs - Should They Be Advertised to Consumers?

- HMO Insurance

- PPO Insurance

- Medical Marijuana - Should Marijuana Be a Medical Option?

- Pet Insurance: Do You Need It?

Print

Print Email

Email